The demand for copper continues to increase as consumption extends into existing and new applications. This has been supported by the global economic recovery and an increase in industrial production. In 2021, the copper price climbed to decade highs marking a 130% growth since March 2020 and is expected to rise further along with concerns over supply and low inventories. Prices have since retreated and remain an average of £7,229.75 per tonne for November 2021, which is considerably different from the average of £5845.42 for January this year. The highly conductive metal is used in a variety of industries, from electronics to automotive, renewables to aerospace, even medical. The extensive properties such as its conductivity, durability, and its power to be recycled all contribute to it being a first choice for upcoming global transition projects, such as energy systems. The recent rapid growth of international infrastructure projects is increasing demand and putting pressure onto supply. Analysts have suggested that by 2050 the worlds industries will require 60 million plus tonnes of copper per year.

What is happening with the global copper market?

In 2020, worldwide production declined by 2% heavily due to the COVID-19 pandemic and the restriction of access to regular working life. Copper supply and demand is currently considered to be in a deficit, meaning there is more market demand than available product. Analysts have suggested that the current global supply and investment plans for critical commodities fall short of what is required to support an accelerated demand of future proofing projects. It is believed that the world’s largest mine, Chile’s Escondida, had reached its peak production and are persistently threatened by the strike of their workers. China’s demand and economic status heavily influences 80-95% of the worlds market for metal prices. This can cause the price to fluctuate by up to £300 per tonne a day, causing a drastic change in daily Metal Exchange prices around the world.

What factors affect the price of copper?

The copper price is constantly changing in a volatile way, spiking to decade highs and experiencing drastic daily fluctuations. Copper is heavily linked to the performance of the global economy because of the significant role that is plays in many of the worlds modern and most progressive industries. When regarding the current market, there is always some recurring key trends, including inflation. This stems from concerns of market inflations, leading to an increase in coppers price. Further, analysts claim whenever exchange inventories fall below one week of global consumption, Copper prices experience a major spike which reflects the recent LME prices. The Copper price has experienced extensive growth in the price due to global economic recovery and the world taking a step closer to major projects such as renewable energy, 5G, key infrastructure, healthcare facilities and electric vehicles and transportation.

Which of the industries are being affected by the growth?

Worldwide demand varies by sector but is expected to grow 1% to 5.3% annually through 2025 based on strong demand in the electronics sector, and expected growth in the renewable energy, housing and automotive sectors. Major growth markets include electrical, communications, construction, industrial machinery, and transportation. Since COVID-19 different sectors have become in higher demand or have taken innovative approaches to remain safe. Antimicrobial Copper is gaining popularity as an alternative to plastic in medical applications. Equipment, such as sterile tabletops and medical trolley handles. The increased amount of people working from home triggered a positive surge in a requirement for more data centres to meet the demand. Due to the high-power demand for data centres, switchgear is a necessity to distribute the power effectively. As data storage continues to grow, more power will be required, resulting in the use of Copper applications.

The rise in popularity of Electric Vehicle’s and the ongoing effect on copper.

The market for electric vehicles (EV) is rapidly changing as leading manufacturers such as Tesla debut new products. Government incentives also continue around the world to encourage people to take a more sustainable approach to vehicle choice. Copper is crucial to EV technology and supporting its infrastructure, with evolving markets having a considerable impact on demand. Copper is used throughout EVs, charging stations and the infrastructure with bus models using up to 814 pounds of Copper which is situated in the battery. The demand, solely based on EVs is estimated to increase by 1,700 kilotons by 2027, having a positive environmental impact as the world moves towards a sustainable future. As the metal is 100% recyclable and can be used and reused without losing its vital engineering qualities, you can start to understand why it is embraced by industry. The UK have announced plans to stop the sale of new diesel vehicles by 2030, with other nations embracing the drive towards EVs use as well.

Copper in renewable energy.

As Copper is a highly efficient conductor of electricity and heat, it is used in renewable energy systems to generate power from solar, thermal, wind and hydro energy across the world. Copper plays a key factor in reducing CO2 emissions and lowers the amount of energy required to produce electricity. As of 2020, there were 617 cities with 100% renewable energy targets, 1852 cities with climate emergency declarations and 10,500 cities with emission reduction targets highlighting the key position of renewable energy systems and the worldwide movement towards clean energy technology. Copper content (per megawatt) in the key energy technologies include solar photovoltaics (PV) containing 5 tonnes, onshore wind farms containing 4.3 tonnes and offshore wind farms containing 9.6 tonnes, with cabling accounting for most of the Copper usage in offshore wind farms. It is estimated that by 2050 renewable energy technology could require more than 3 million tonnes of copper each year, accounting for 15% of global mine production in 2020.

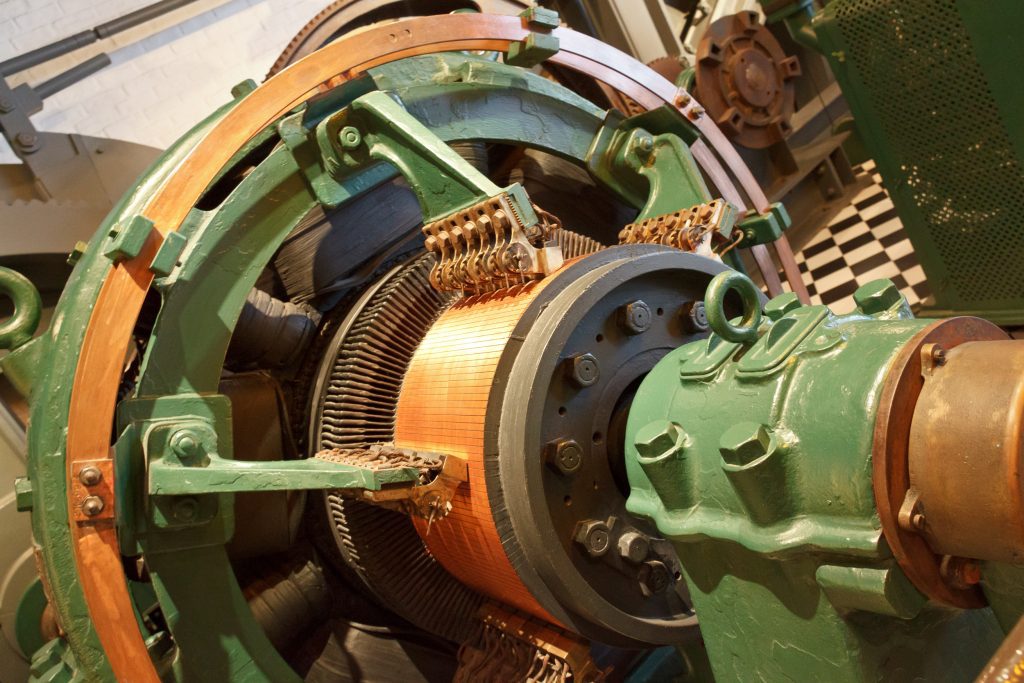

Copper Consumption as an Industrial Metal

In terms of quantities consumed, industrial copper consumption is ranked directly behind Iron and aluminium. Highly prized for industrial usage, the base metal is similar to nickel, zinc, aluminium and lead, although copper is the most conductive nonprecious metal.

Future of the copper market.

The demand for the highly prized metal is growing and it is estimated that in the next 20 years, according to analysts we are expected to see a 50% increase in demand. This is heavily supported by the aim for a sustainable future with increased use of renewable energy sources and energy efficiency. Currently, global reserves are estimated at 830 million tonnes and an annual demand at 28 million tonnes. It is reported that the industry is already investing heavily in innovation and sustainable solutions helped by being 100% recyclable, however, it is argued that more can be done. The future for the Copper price continues to be unpredictable as demand and supply remain in deficit. Leading analysts remain bullish on the market, claiming that it is fast becoming the most mispriced commodity in the complex. It is estimated that prices will surge to over £11,000 per tonne by 2025.

Copper Fact

The shiny metal that industry, especially the electric industry loves, also has many other uses.

Copper is being more and more used as an antimicrobial metal, with antimicrobial copper able to kill 99.9% of bacteria within two hours of contact.

As humans, copper is an essential nutrient and crucial to our diets. Natural trace amounts found in our food can aid our bodies to function properly, although like most things in our lives, a little does you good, whilst a lot can cause damage to our bodies.

The metal can be found as a trace element in a variety of foods including liver, lobster, leafy greens, oysters, and dark chocolate amongst others.

The benefits of including in our diet include production of red blood cells, absorption of iron, and regulation of blood pressure, although don’t overdo it!

Milly Edwards

Sales and Marketing Executive: Responsible for creating content for ILF's social media channels, website, print media and promotional work.